Decentralization, Recentralization

Chapter 4

The Possible Futures

Narrated by Balaji AI.

It’s not about the future, it’s about the possible futures.

Why? Because causality exists. Because we can run controlled experiments. Because human action can influence outcomes. Because we aren’t communists that believe in the historical inevitability of utopian outcomes, but technologists that believe in individual initiative subject to practical constraints.131

The previous two chapters were about those constraints, about the past and the immediate present. They orient us to discuss several possible futures, before picking out one trajectory to focus on - the one where we materialize many startup societies, get a few diplomatically recognized as network states, and rebuild high-trust societies via a recentralized center.

Some caveats before we begin, though.

When it comes to the past, every history is, inevitably, just a story.132 That is, any tale of the past is necessarily abridged, abbreviated, edited, and idiosyncratic. You can’t convey 5000 years of written records any other way. And our tale of History as Trajectory is no different: it’s like the “why now” slide at the beginning of every entrepreneur’s deck, a practical history133 of particular events that lead to the feasibility of the network state. But we cited our references, so you can check our facts.

On the topic of the present, our chapter on the Tripolar Moment is the section of the book that is likely to be the most dated. Intentionally so, because we endeavored to move most references to current or near-past events to this section.134 So, think of that chapter as being very much a worldview circa mid-2022; like the Kalman filter, we reserve the right to incorporate new information to update it.

Now to the subject of the future. As you’ll see we do believe a recentralized center of pragmatic network states can emerge, and describe several scenarios where this could happen. But our projections are just scenarios, and throughout we keep in mind volatility, reflexivity, competing curves, and the consequent limits to predictability.

First, volatility is rising because the internet increases variance. Social media is social volatility (go viral or get canceled), and cryptocurrency is financial volatility (go to the moon or get rekt). Volatility makes correct predictions more difficult, but offers upside for those who predict correctly. And volatility is good for insurgents and bad for incumbents, because the former only need to get lucky once while the latter need to keep staying lucky. It’s no longer just individuals that are subject to high volatility, as entire countries can rise and fall overnight. So, in a high volatility environment, only Bezos-style invariants remain constant. All other observations should be taken as tentative — they are true until they are suddenly not.

Reflexivity is Soros’ term for the feedback loop between participants’ understanding of a situation and the situation in which they participate. In systems made of human beings, putting something out into the world results in a reaction, and then a reaction to that reaction, and so on, often resulting in positive and negative feedback loops rather than textbook convergence to equilibria. Thus, when collecting data on such systems, let alone forecasting them, one must keep in mind that people will react to predictions themselves, sometimes to make them come true. In social science, unlike physical science, every row in a dataset represents a human being with a mind of their own.

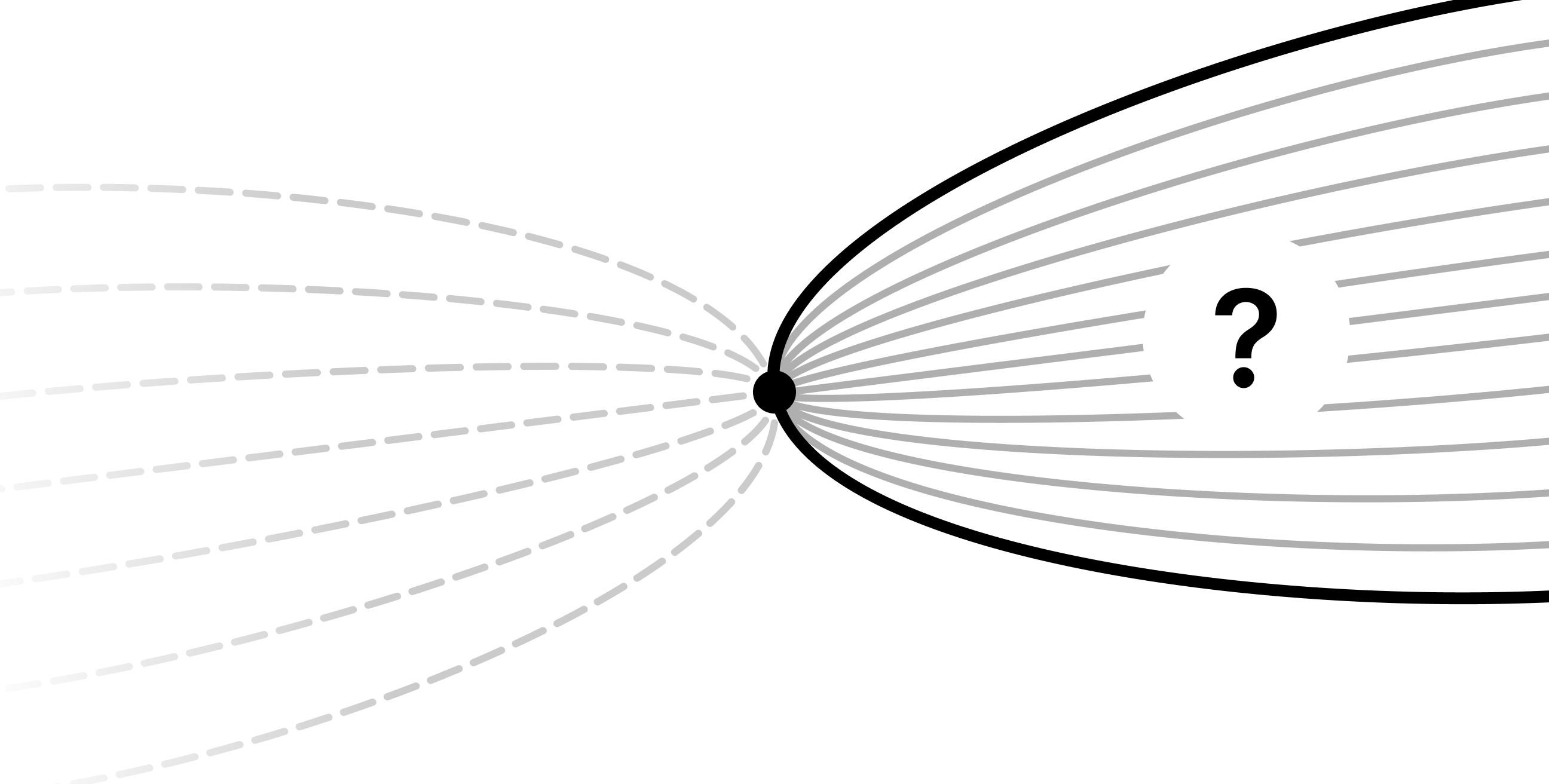

The concept of competing curves refers to the fact that there are many simultaneous technopolitical movements competing at the present moment, different phenomena rising from zero to affect millions over the course of years, months, or even days. For example, if you take a look at this graph of how people met their spouses, you can see several different curves rising and falling as different cultural movements “come online,” until the internet just dominates everything. Another example is the market share of social networks over time; a third is Ray Dalio’s graph of the rise and fall of nations.

The point is that you can identify the players, but not always the outcome, in a complex multiactor process. Applying this to our scenario analysis, we have some trends that are synergistic and others that are antagonistic. For example, many trendlines point to diminished American power, but at least one points in the other direction: the West’s willingness to weaponize its tech giants for domestic and foreign conflicts alike. Does this give American dominance another few years, another decade, or many more than that? We can identify the curves but not always which ones win out.

Predictability has its limits. In our view there are two kinds of predictions that matter: the physical and the financial. The physical prediction is a very specific bet on the trajectory of a ball, on a genomic base call, or on the electron configuration of an orbital. It’s checked by reproducible experiment, and your device fails if it fails. The financial prediction is at the opposite end of the spectrum: it’s a macroscopic bet on the volatile, reflexive behavior of other human beings. It’s checked by the unforgiving market, and your fund fails if it fails.

We aren’t as interested in betting on manipulation-prone government statistics. According to the Chinese government of 2021, the number of COVID deaths in China from mid 2020-2022 was zero. According to the San Francisco government of 2021, the crime rate in SF was declining. According to the US establishment of 2021, the inflation of the dollar was transitory. All this reminds us of the Soviet government of 1932, who said the harvest in Ukraine was glorious.

As we discuss later, it is useful to create on-chain shadow statistics that are more verifiable, reliable, and censorship-resistant than these easily faked indicators. But outside of that, predictions on official government statistics are otherwise uninteresting because of how obviously political they are. So we steer clear of that kind of thing — in our analysis of possible futures, we’ll either predict something is technologically (and hence physically) feasible, or that it could result in a financial return, or both. And we’ll give recipes for how to make those predictions reality, or prevent them from becoming reality, in the form of fictional scenarios on good and bad futures.

So, to recap: our history is just a story, our analysis of the present may presently be dated, and our forecasts for the future may be confounded by volatility, reflexivity, competing curves, and the limits of predictability. With that said, all models are wrong, but some are useful; so with caveats cataloged and provisos provided, let’s proceed!

Analytical Axes and Scenario Analyses

We start by describing new lenses to view the world in the sections on Sociopolitical and Technoeconomic axes. These are mental models that hopefully help compress large amounts of data into rough patterns.

Next, in the section on Foreseeable Futures, we put on our tech investor hats and project out into the near future, describing developments we anticipate. These aren’t just random investment theses, though; they’re pieces of the future that are relevant to startup societies and network states.

We then game out one specific science fiction scenario in detail that we think is unfortunately quite plausible: American Anarchy, Chinese Control, and the International Intermediate. In this scenario, we project a Second American Civil War triggered in part by a broke US government that attempts Bitcoin seizures, a situation we call American Anarchy. Unlike the first Civil War, this would be a stochastic struggle between two Networks rather than an explicit dispute between two States. It would be more undeclared than declared, more invisible than legible. And this conflict could end in decentralization and disunion instead of centralization and consolidation. As radical as that sounds, many thinkers from across the political spectrum already foresee something like this happening in different ways, including Stephen Marche, David Reaboi, Barbara Walter, and Kurt Schlichter, though like me none of them are particularly happy about the prospect.

Meanwhile, in this fictional scenario, the CCP implements an intense domestic crackdown on the other side of the world to maintain stability, preventing Chinese people from freely leaving the digital yuan network with their property, a result we refer to as Chinese Control. As America descends into anarchy, the CCP points to their functional-but-highly-unfree system as the only alternative, and exports a turnkey version of their surveillance state to other countries as the next version of Belt and Road, as a piece of “infrastructure” that comes complete with a SaaS subscription to China’s all-seeing AI eye.

In the name of putting a lid on the anarchy and restoring “democracy”, the US establishment then silently copies CCP’s methodology without admitting they’re doing so, much as they cloned China’s lockdown after loudly denouncing it. Similarly, after spending a decade pretending to decry “surveillance capitalism”, the US establishment formally deputizes many Big Tech companies as official arms of the surveillance state. However, the establishment’s implementation of this digital lockdown is as tragicomic as the CCP’s version is totalitarian, and is porous enough to permit serious resistance.

Strong Form and Weak Form Models of the Future

This is the world we could be barreling towards. You don’t have to believe in it to found a startup society, though. So why talk about it at all then? Because in a high volatility time, it’s worth thinking through models of how our future could be very different from our present.136

Think of the American-Anarchy-vs-Chinese-Control scenario as a strong form model of how NYT, BTC, and CCP could collide, with startup societies and network states arising out of that atom-smasher as deliberately created alternatives to Wokeness, Maximalism, and Chinese Communism.

The weak form model is that things don’t work out precisely this way (few things do!), but that the general trend is correct. That is, in the future the US Establishment does lose relative control, the CCP does try to exert absolute control, and Bitcoin Maximalists do advocate for no control. The way of life propounded by each of these ideological communities will get extreme, but will also be itself justified as a reaction to the other two perceived extremes, as discussed in Extremes and Counter-Extremes Are Undesirable. So we’ll still need to build societies with consciously chosen tradeoffs between submission, sympathy, and sovereignty, instead of unconsciously capitulating to either an extreme or counter-extreme. And that again leads us to startup societies and network states.

So, using the strong-form scenario as a base, we discuss a number of Victory Conditions and Surprise Endings for different factions. We also give a bit more detail on the desired outcome, the trajectory we want to shoot for: a Recentralized Center of high-trust societies.

Building the Future Rather than Defaulting Into It

Our goal in thinking all this through is not pessimistic but pragmatic: to change what we can change, by setting up a fourth pole as an alternative to the failing US establishment, to maximalist crypto-anarchy, and to the centralized surveillance state of the CCP.

We call the raw material for this fourth pole the International Intermediate. It includes American centrists, Chinese liberals, Indians, Israelis, web3 technologists, and essentially everyone from around the world that wants to avoid both the American and Chinese whirlpools.

At first blush, this group represents ~80% of the world population and has little in common save their disinclination towards both anarchy and tyranny. But a subset of them will be smart enough to realize that exit is a stopgap, not a solution. People tend to imitate what they see, and if American Anarchy and Chinese Control are the most prominent games in town they will eventually be imitated.

So isolationism is off the table. Yet so is direct intervention, as both the American and Chinese theaters will snarl against any outside interference.

The answer then is innovation rather than isolationism or interventionism. A subset of the International Intermediate needs to build something better than both American Anarchy and Chinese Control, a concrete improvement over the propaganda, coercion, surveillance, and conflict that may soon characterize the two pillars of the global economy.

In other words, the rest of the world will need to lead. They can’t hope for the US establishment or CCP to figure it out. And that’s the Recentralized Center: a circle of startup societies and network states built by pragmatic founders, a group of high-trust communities architected as intentional alternatives to failed states and surveillance states alike.

Next Section:

Sociopolitical Axes